The Last Notes

The Credit Squeeze of 1960

Australia came out of World War 2 with a tightly regulated banking system. Hire-purchase companies were about the only available source of formal consumer credit in Australia and this method of financing grew quickly in the 1940s and 1950s. By the early 1960s Hire-Purchase was sometimes referred to as Australia’s “second banking system”. In November 1960, the Australian Treasurer announced a ”mini-budget” that reduced tax deductions on borrowings by business. Overdraft rates rose and banks were instructed by the newly-created Reserve Bank to cut lending. The Treasurer’s action was deeply unpopular and reintroduced Australians to the experience of mass unemployment.

About 2/3 of the credit advanced by HP companies in Australia had been used for the purchase of motor vehicles, and 1/3 for the purchase of household goods, particularly refrigerators, washing machines, furniture and, increasingly after the introduction of television in 1956, TV sets. At the end of January 1961 the hire purchase debt of Australians amounted to £100 per adult person. Data on consumer credit was not centrally collected in Australia until the 1960s because the sector was largely unregulated, and firms were not required to report their activities, unless they were public companies (which Suttons wasn’t). Like most trading businesses, Suttons had loans – with the ES&A bank, and also with the UK finance company, Lombard.

By the early 1960s there were indications of serious problems with Suttons’ cash flow, resulting in substantial losses for the company.

Below : TROVE Canberra Times 16 November 1960

From an interview with Doug Jones in 1998 regarding this period :

“Suttons was a private company, and this meant the ways available of raising finance were limited. After WW2 there was significant inflation, so to finance purchases became difficult. Suttons wanted to retain their hire-purchase accounts so to get extra capital they started borrowing from banks. Then as things tightened up further, Suttons had to pay their profits to banks instead of their shareholders.”

Below : TROVE Tribune 3 May 1961

Brash Holdings Limited was a similar organisation to Suttons, and had been one of their competitors for 100 years. Brashs found themselves in similar financial circumstances to Suttons, but decided to “float their company” ie “go public” to raise their needed extra finances. The Suttons auditor at that time also happened to be the auditor of Brashs. Some years earlier he had become interested in Suttons and invested some of his money with the company, thereby becoming a Suttons shareholder. Suttons at that time had been a good investment, but as time passed, he became concerned about losing his money. He interested Geoff Brash, the Brashs manager, in making an offer for Suttons, which was still trading satisfactorily but not making any profits.

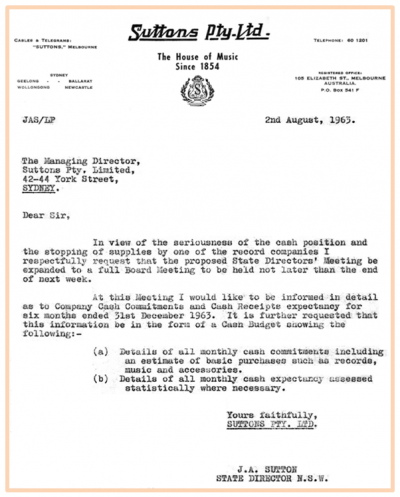

Sutton family archives contain correspondence which includes a letter addressed to Stan Stubley, the manager of the Sydney store, written by Jeffrey Sutton in Newcastle NSW [below]. Jeff appears to demand he be fully appraised of the firm’s current situation, the implication being that he had not been kept informed of the seriousness of the whole firm’s current financial position.

Late in 1963, prior to agreeing to any takeover offer, Suttons’ Managing Director, Douglas Jones personally visited every Suttons shareholder to entreat them to sink more funds into the floundering company, to no avail. He was the only Sutton family shareholder prepared to put extra money into the business to keep the company trading, and did so, until the final decision was taken to surrender his family’s music business. He was personally devastated at this outcome.

Jeff Sutton reportedly said later “the Suttons management had brought the company to the position where its shareholders finally lost confidence in them, and a merger with a respected competitor – Brashs – was negotiated”.

In the first week of December 1963, the Suttons’ Company Secretary, George Armstrong, was instructed by the Board of Directors to write to all the Suttons shareholders to advise them of the seriousness of the company’s situation, and to say they believed the only route open to the company was to amalgamate with the similarly inclined company, namely their competitor, Brashs.

When the time came for the deciding vote by the Suttons Board of Directors whether to accept the take-over offer by Brashs, Douglas Jones was the only director NOT to vote in favour of the accepting it.

Brashs offered a one-for-one share arrangement to Suttons shareholders.

Part of the arrangement offered to Suttons shareholders by their (Suttons) company was that of the availability of a buyer who would buy up to 10% of any unwanted Suttons shareholding, for a certain price – that buyer was Jeff Sutton. In all, only 3 shareholders took up his offer; all were Sutton family members : F.George Sutton, his wife, and George’s sister, the widow of J.M.Sayer.

On 7th February 1964 all 5 members of the Suttons’ Board of Directors :

Douglas Jones, Stanley Stubley, Alex Law Jr, Jeffrey Sutton and F.George Sutton formally resigned.

On 21st May 1964, after 110 years of trading,

the Music House of Suttons ceased to exist as an independent entity .

Douglas M. Jones was offered, but declined, a position with Brashs.

F.George Sutton was offered, and accepted, a position on the Brashs’ directorate as a representative of Suttons; he died a year later.

Both the Sydney & Newcastle stores were closed; Jeffrey Sutton was recalled to Melbourne where he was offered, and accepted, the position of General Manager of Suttons’ Victorian branches. He was appointed to the Brashs directorate on 10 August 1967.

George Armstrong continued as Suttons Company Secretary, under the Brash Holdings umbrella.

The Suttons staff were retained under the new arrangement, and Brashs agreed to let Suttons continue to trade under its own name. This situation continued until 1978 when all Suttons branding was replaced by Brashs.

Jeff Sutton formally resigned from Brashs on 1 July 1978, but continued as a Brashs director for some further years.

When the Brashs company itself suddenly collapsed without warning in 1998, any Suttons shareholders who had accepted Brash shares in lieu of their Suttons shares, and kept them, lost all their value. Both Jeff Sutton and Douglas Jones were among them.